Earnnest is the largest digital earnest money service in the U.S. because we make earnest deposits safe and easy. Add your escrow holding business to the Earnnest network and start collecting earnest money deposits digitally.

Learn how

If you or your administrator would like to register your escrow-holding organization with Earnnest, contact a Strategic Partnerships team member by completing our escrow registration form and calling (864) 973-7400.

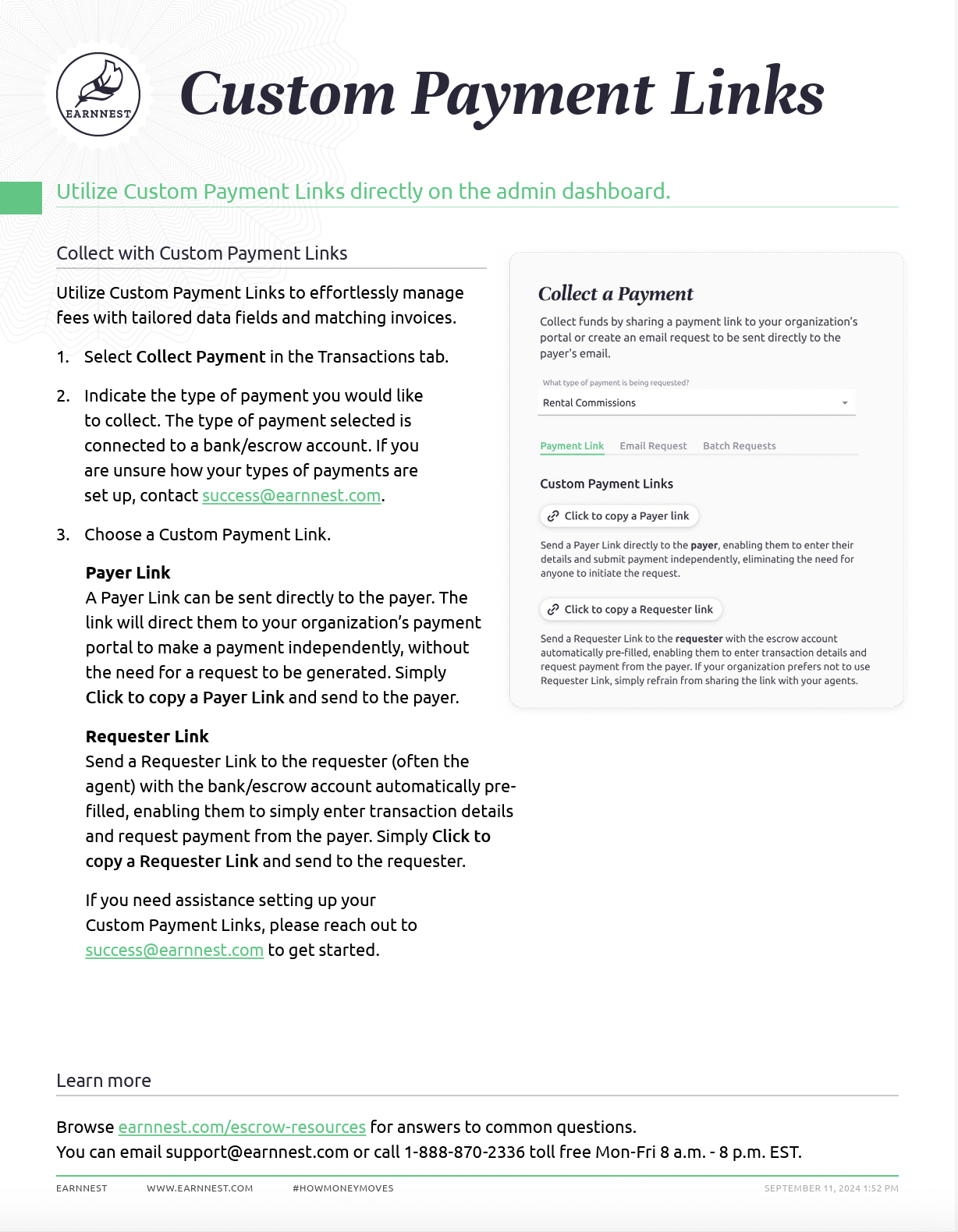

Earnnest's Payment Portal lets you collect earnest deposits directly from your website. Agents won't need to send a payment request to buyers. Instead, the buyer simply clicks the custom link on your website to access your customized payment portal and send their deposit.

We've made it easy to collect earnest money digitally. Here's how it works:

Learn more about the escrow holder experience with these commonly asked questions.

How is Earnnest different from a check or a wire transfer?

Here's what makes us special.

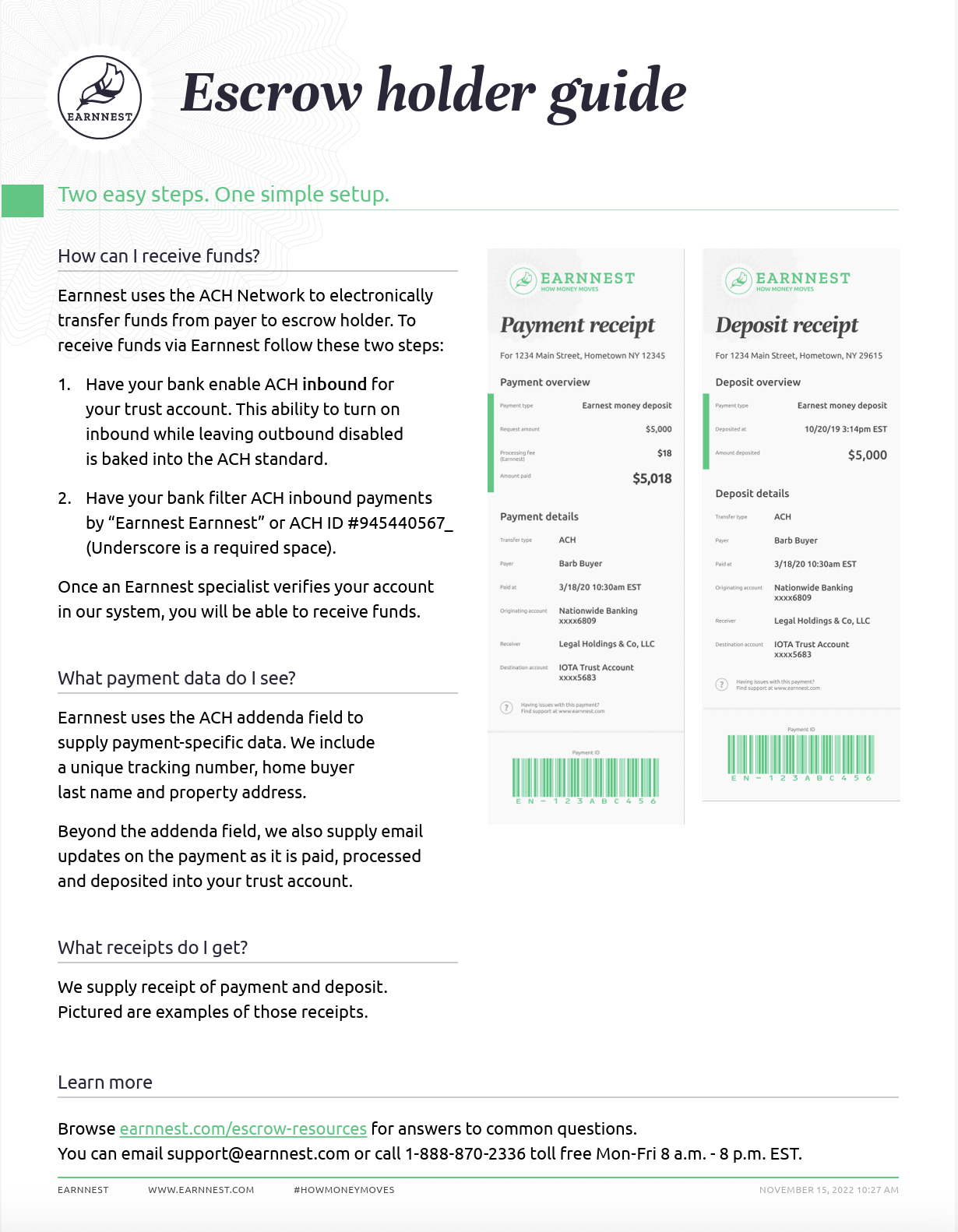

You receive documentation at each step of the payment process including

authorization and deposit.

Why don't I see my escrow account when I search for it?

Check the state and the status.

Earnnest offers the security of SOC 2 Type 2 certification.

We verify every account—both sending and receiving—before any transaction begins.

We never see or store payer account numbers, routing info, or login credentials.

We utilize banking-level encryption to keep private information secure.

By verifying the homebuyer's identity, we comply with federal laws (like the US Patriot Act) and meet the requirements of organizations like the Treasury Department and the NCUA.

Track payment status from requested to deposited

Manage and add new escrow accounts

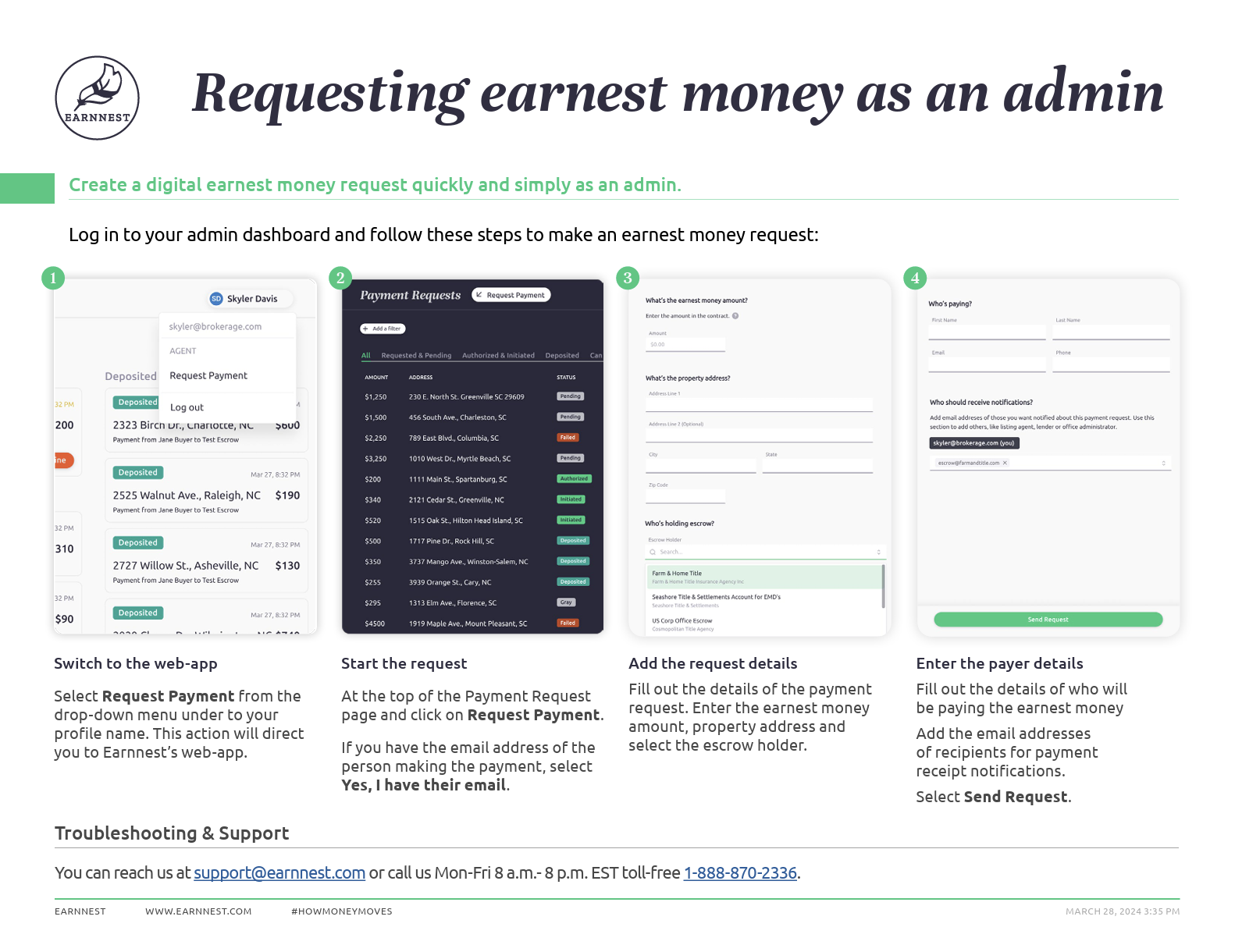

Request an earnest money payment

Reconcile accounts easily

Get your escrow account(s) up and running with the steps below.

After registering your organization with Earnnest you will add your escrow account(s).

Start by signing in to your account. Click manage escrow accounts and then register escrow account.

Next, add your escrow account information.

Confirm ACH inbound is turned on for the account. You can learn more about enabling ACH inbound by scrolling down to the next question.

Add up to six accounts by repeating the steps above for each account.

If you wish to add more than six accounts, contact our team, as further verification will be required.

Note: Earnnest uses ACH transfers to deposit payments into account(s) registered with us. ACH inbound will need to be turned on for each account you register with us. You can learn more about enabling ACH inbound by scrolling down to the next question.

Earnnest uses micro-deposits to verify your account. In 1-2 business days you will receive an email to inform you when your micro-deposits are ready. View the bank account you registered and enter the amounts of the two small deposit you received into Earnnest to finish account registration.

Earnnest uses ACH to transfer funds from payer to escrow holder. To receive funds via Earnnest you will need to enable ACH inbound for your account(s). First, ask your bank to enable ACH inbound for your trust account(s). Next, ask your bank to filter ACH inbound payments by either “Earnnest Earnnest” as the business name or by Earnnest’s ACH ID #945440567_ (Underscore indicates a required space).

As an administrator of your escrow account(s), you have the option for us to set a limit on the dollar amount per transaction that can be deposited to your account(s). If an agent attempts to create an Earnnest request with an escrow amount that exceeds your limit, they’ll be notified of your limit settings and prompted to edit the request (see image below).

Contact our team to add an escrow deposit amount limit to your account.

Ready to tell the agents in your network about your digital earnest money tool?

Use our Marketing Resources to spread the word.

Share the Agent Resources page so agents can learn how to get the free Earnnest App, how to send a digital earnest request, and more.

Schedule a Training for your employees.

Earnnest is free for escrow holders and agents to use.

We charge a flat convenience fee of $18 to the homebuyer to transfer their funds. That is less than most wires and the same as a cashier's check — just more convenient.

No. Earnnest will neither have access to your funds, nor be able to see how much is held in your account.

Earnnest uses an Automated Clearing House (ACH) to transfer your funds safely and securely.

Moving money through Earnnest is cheaper than most wire transfers and quicker than a check.

And unlike a check or wire transfer, moving money with Earnnest has no risk of fraud.

Earnnest deposits take between one and three business days to deposit into your escrow account once the funds have cleared the payer's account.

The requesting agent, payer, and escrow holder admin receive email notifications throughout the payment process. As an escrow holder admin you will receive notification when the buyer authorizes their earnest money payment and when the money is deposited in your escrow account.

Log in to your Admin Dashboard and select Track Payments.

Before you can initiate a refund, you will need to turn on the Refunds functionality on your account. Contact our Success Team to turn on Refunds for your account. Once Refunds are turned on, follow the steps below:

Log in to your Admin Dashboard and select Track Payments. Click the Refund button and confirm to initiate your refund. Once initiated, a new transaction is created and will appear in the Paid & Processing column in your dashboard. This allows you to track the progress of the refund on its way back to the homebuyer. The new transaction is marked with a blue Refund status badge and the original transaction is marked with an orange Refunded status badge for extra clarity in tracking. Once the refund has been deposited in the homebuyer’s originating account, the newly created transaction will move from Paid & Processing to the Deposited column in your dashboard.