Pay your earnest money digitally using any bank, at any time, from anywhere—even your couch! Digging out your checkbook and driving a check across town to escrow is now a thing of the past.

Learn more

We've made it easy to pay your earnest money digitally. Here's how it works:

Earnnest provides flexible ways for real estate agents and escrow holders (think closing attorneys, title companies, etc.) to collect your earnest money payment securely.

1. The first way is by your real estate agent sending you an earnest money request via email. The email you receive will come from Earnnest. If this is how your real estate agent requests you to pay earnest money, follow the instructions in the "Payment Request Email" video below.

2. The second way is by initiating payment directly to your escrow holder through their Earnnest payment portal. If this is how your escrow holder requests you to pay earnest money, follow the instructions in the "Branded Payment Portal" video below.

If you have a question about which method to use, please contact your real estate agent and escrow holder.

Once you pay, a payment receipt will be generated automatically and emailed to you. The agent, the escrow holder, and any other parties your agent included in the request will also receive receipts. When the money is deposited, a deposit receipt will automatically be sent to you and the escrow holder.

Earnnest is an ACH payment and utilizes the Automated Clearing House (ACH) network — a U.S. financial network used to send money electronically. ACH payments (also called electronic funds transfers) are relied on by the federal government as the standard for secure money movement within the U.S. banking system.

You’re already familiar with ACH payments. Even if the term “ACH” doesn’t ring a bell, your every day payments use the ACH network. Common examples are the direct deposit paycheck you receive every two weeks, or the phone bill and mortgage payment you’ve set to draft automatically each month. ACH payments are preferred to checks or wires because they are faster than checks, cheaper than most wires, and more secure than either checks or wires.

The ACH network is governed by the National Automated Clearing House Association (NACHA). This association exists to regulate the ACH network and requires all parties to meet standards of security, encryption, and identity verification. So you can rest assured that you are using the most secure payment option available.

We get it. Sometimes homebuyers run into an issue completing their earnest money request. We’re here to help. Give us a call, or check out these common questions from homebuyers.

If the bank account you want to pay with does not appear you can add it manually.

Add account manually.

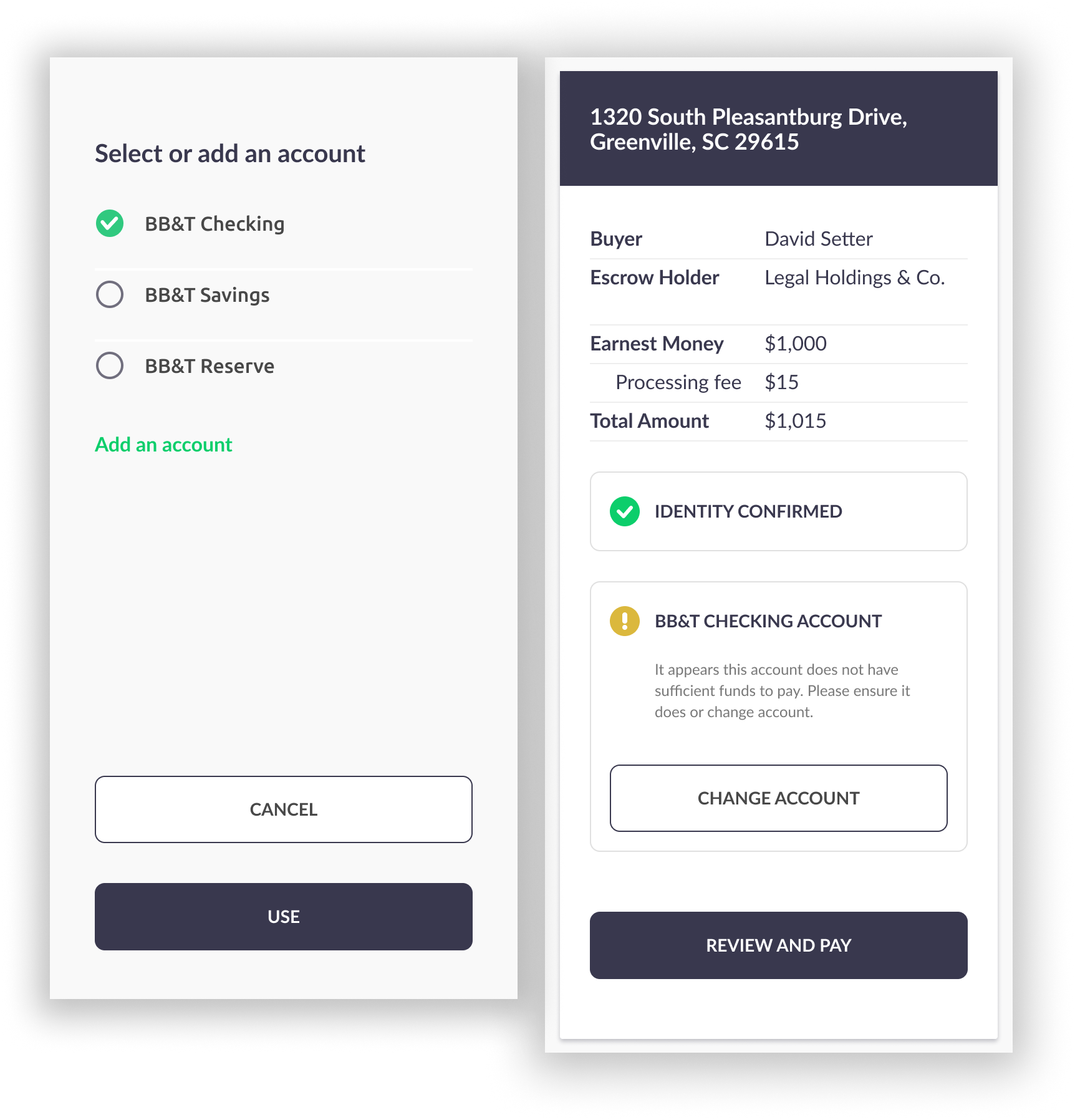

If your account has insufficient funds you'll be notified to select another account.

See how it works.

We recommend using a traditional checking account to pay your earnest money.

Learn more.

Earnnest never sees or stores your private details. Your security is important to us.

Get all the details.

During the earnest payment process, you will be prompted to make a temporary, secure connection to your bank. Use the search bar to locate your bank. If your bank does not appear you can add it manually.

Learn how in the video below:

Earnnest will run a preliminary check for sufficient funds in your account of choice. When our system detects that the account does not have sufficient funds, we will prompt you to add an alternate payment account. This feature helps to eliminate the headache of bounced checks and the inconvenience of dealing with insufficient funds.

Earnnest recommends using a traditional checking account to pay your earnest money.

You are able to use a savings account, however; be aware that there is a six-payments-per-month limit on all savings accounts. If you have already made six payments from your savings account and try to transfer your earnest payment as a seventh withdrawal in the month, then the payment will fail.

We do not suggest making earnest payments from money market accounts or prepaid cards, as these types of payments have a higher likelihood of failing.

We've made it easy to collect earnest money digitally. Here's how it works:

When Anne Hernandez heard her homebuyer was unable to purchase groceries due to check fraud she knew it was time to switch to Earnnest.

Read how Earnnest protects buyers from fraud.

Your security is important to Earnnest. We never see or store your account numbers, routing information, or login credentials. We work with industry experts, like Plaid, to secure your transaction at every stage of the process. Earnnest uses 256-bit encryption, two-factor authentication, and tokenized account access to keep you and your data safe.

Earnnest's digital payments completely eliminate check and wire fraud by eliminating checks and wires all together. Our transactions have experienced zero instances of fraud.

Earnnest eliminates wire fraud by eliminating wires.

In real estate, cybercrime frequently takes the form of wire fraud. Criminals reach out directly to homebuyers pretending to be an agent and requesting funds be wired to fraudulent accounts — wiping out homebuyers’ savings in the process. ALTA.org reports less than 29% of these cases fully recover their lost funds.

Earnnest has solved this problem by eliminating wires. Our digital payments use a fully vetted, closed network of escrow holders. This means fraudulent accounts can not show up in the transaction. When creating an earnest deposit request, the agent chooses their trusted escrow account inside our secure system. When the buyer pays, the receiving account is already selected and the funds transfer to the correct account, every time.

Earnnest eliminates check fraud by eliminating checks.

The issue with personal checks, is that all of our most personal banking information is printed on the front of every check (account numbers, name, address, etc.). When checks become intercepted the door is opened to check fraud. Earnnest’s secure digital process completely eliminates paper checks thereby eliminating check fraud. Buyer’s information stays private in our encrypted system during payment. Plus, Earnnest never stores homebuyer information.

We partner with Plaid, a bank network provider, that grants us one-time, tokenized access to a homebuyer's bank. Plaid's network of over 13,000 instantly verifiable banking institutions allows you to search for your bank, log into your online banking through the bank portal, and then link your account in moments. Earnnest does not see or store banking credentials—ever.

Once you give Plaid permission to share your financial data, they securely transfer it from your financial institution to the Earnnest app through their application programming interface using Advanced Encryption Standard (AES-256) and Transport Layer Security (TLS). The only information that Earnnest receives is an encrypted token that we use to create your payment.

Plaid is used by companies like Merrill Lynch, Zelle, and Venmo. When you connect with Plaid, you have control over who you’re sharing your data with. To manage the connections between your financial institutions and your apps, or to delete your data from Plaid’s systems, visit my.plaid.com.